House Speaker Paul Ryan has stood by quietly as Rep. Kevin Nunes (R-CA) worked as the White House’s water boy. Ryan said nothing when Donald Trump called African countries “sh*th*le” places. He has even let Donald Trump threaten the pillars of the country’s democracy. Why?

When Mitt Romney was running for president in 2008, he chose Speaker Ryan for his vice presidential running mate. As such, the representative sat in on confidential meetings. The briefing in one top-level meeting was with the Fed chair, and it indicated that the banks were just about to fall off of a very steep cliff, one that nearly bankrupted the country and created the Great Recession.

If President Barack Obama had not taken the effective steps he did, the country would have faced a second Great Depression. Fortunately, he turned the great ship America around, and we have the economy of today.

What about Ryan, though? After that meeting with the Fed chair, he went out and sold his stock in American banks, according to The Guardian. Yet, the speaker just denied profiting from that top-secret information from then-Fed chair, Ben Bernanke, and former treasury secretary, Hank Paulson.

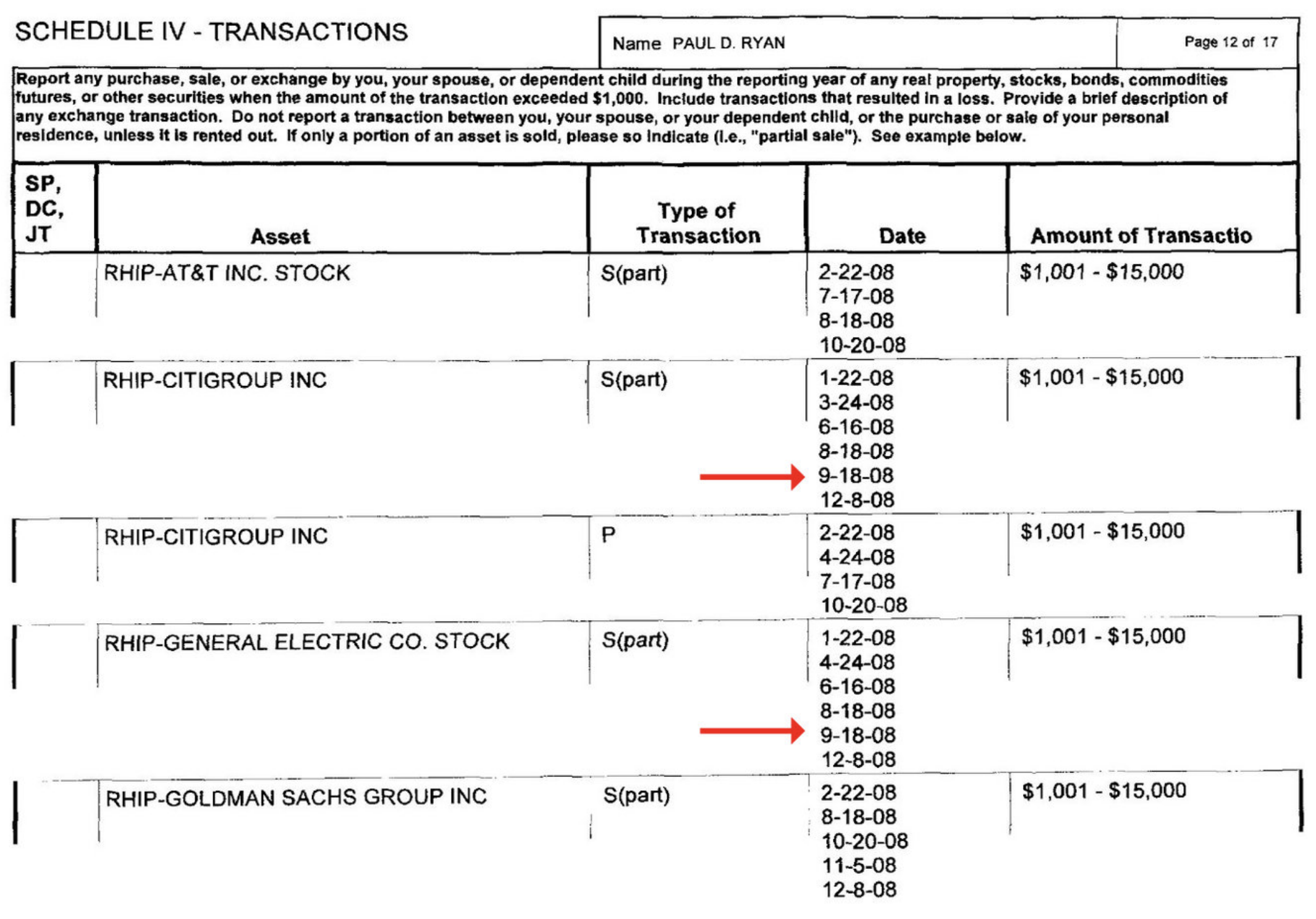

According to public records. Ryan immediately dumped his own stocks in Citigroup and Wachovia. Then, he purchased stocks in Goldman Sachs. Paulson had worked for Goldman and information he obtained in the top-secret meeting indicated that this bank would do better than the others.

Business Insider analyzed Ryan’s 2008 financial disclosures. It found the sales could be significant:

‘The sales total as much as $60,000 — although they could be considerably less. The House disclosure forms do not require specific values from members.’

Ryan’s net worth is “$927,100 to $3,207,000,” which is far lower than many members of Congress.

True to the experts’ prediction, Wachovia’s stocks plummeted 39 percent in one day. Citigroup’s stocks dropped precipitously, too.

Unlike most Republicans, the speaker was all for the Tarp bailout of the big banks. Was it any mistake that Wells Fargo and Goldman Sachs are major donors to his campaign?

According to Larry Gaffney, an independent accountant managed the trades, and the speaker had no control over them, The Guardian reported:

‘Trades are done automatically based on an algorithm on a regular basis. In addition, this index was held at the time within a partnership in which Rep. Ryan had and continues to have no trading authority.’

Members of Congress had been free to trade on price-sensitive information gleened from Washington information.

Fortunately, President Obama signed into legislation a protection against Congress members, plus other federal employees, profiting from private government information, the Trading on Congressional Knowledge (Stock) Act, including insider trading. Now, Congress members have to post any information about transactions over $1000.

The Office of Congressional Ethics cleared the chairman of the House Financial Services Committee, Spencer Bachus, of allegations of insider trading. The charge involved taking advantage of insider trading multiple times.

Interestingly enough, Bachus attended the meeting with Bernanke, Paulson, and Ryan. Immediately after, he traded “short” options. In other words, he was betting that the banks’ stocks would drop.

Senator Chuck Schumer (D-NY) spoke to The New York Times:

‘When you listened to him describe it you gulped.’

Featured Image via Getty Images/Mark Wilson.