The topic of Trump’s taxes has remained somewhat of an enigma ever since the businessman first rose to national prominence. He promised to release his personal tax returns at one point, an act that would allow the public to more fully scrutinize his financial connections, but he has withdrew that promise after taking office.

Now, thanks to a new report from The Wall Street Journal, another example of just why that might be the case has come out.

According to the publication, the Trump Organization’s online store only collects and pays up taxes in two states, Florida and Louisiana. Under current regulations, online retailers are only required to do such a thing in states where they have a physical presence, which is why the store doesn’t collect or pay sales taxes in the state where it’s technically based, New York.

The irony here is that the president has gone on and on against online retail giant Amazon recently for supposedly getting around paying their fair share of taxes to state and local governments.

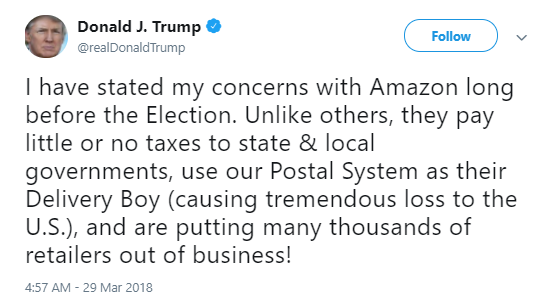

For instance, on March 29 of this year, the president posted a message to Twitter about Amazon reading in part:

‘Unlike others, they pay little or no taxes to state & local governments, use our Postal System as their Delivery Boy (causing tremendous loss to the U.S.), and are putting many thousands of retailers out of business!’

There’s just one problem with the president’s line of reasoning.

Amazon as an entity collects sales taxes on its products in 45 states and the District of Columbia — in other words, they collect sales taxes on their goods sold in 44 more jurisdictions than the president’s business collects sales tax in.

To be clear here though, the president’s attacks on Amazon have never really been about Amazon itself. The man behind Amazon, Jeff Bezos, owns The Washington Post, and we all know what our commander-in-chief thinks of the mainstream media.

He has coupled his attacks on Amazon with the patently false claim that The Post acts as a lobbying arm for the company that made Bezos famous.

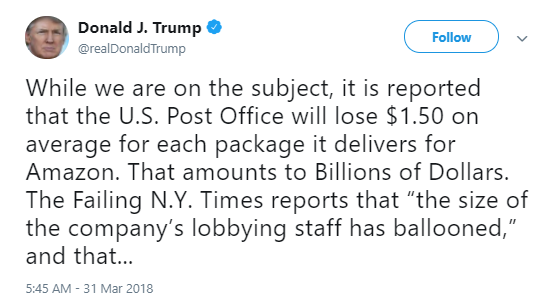

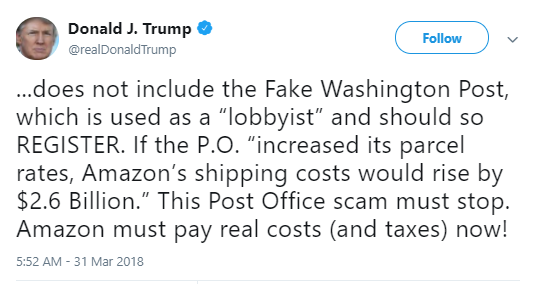

For instance, on the last day of this past month, the president, speaking of Amazon, posted a statement to Twitter reading in part:

‘The Failing N.Y. Times reports that “the size of the company’s lobbying staff has ballooned,” and that does not include the Fake Washington Post, which is used as a “lobbyist” and should so REGISTER.’

The president is not going to get out of the accountability for his actions facilitated in part by the press through claiming that the press isn’t really the press and is instead just a group of lobbyists in disguise. Reality exists independent of the president’s statements, an idea that only in the era of Donald Trump becomes contentious and pointed.

CNBC reports that in the face of the president’s criticisms of Amazon falling flat, a White House spokesperson has claimed that the president has been speaking of third party sellers on Amazon, and not of the main corporation, when ranting about supposed unfair tax evasion.

It’s not that easy to pick up the pieces here, though. The president has continuously said “Amazon” when ranting on Twitter, not “third party sellers on Amazon.”

Additionally, outside of the issue of the president’s business’s online store getting out of paying taxes in most states, the president himself has bragged about paying as little in taxes as possible.

Overall then, the president’s campaign against Amazon doesn’t change the reality that his business is guilty of what he accuses Amazon of carrying on with.

Featured Image via Yuri Gripas/Bloomberg via Getty Images