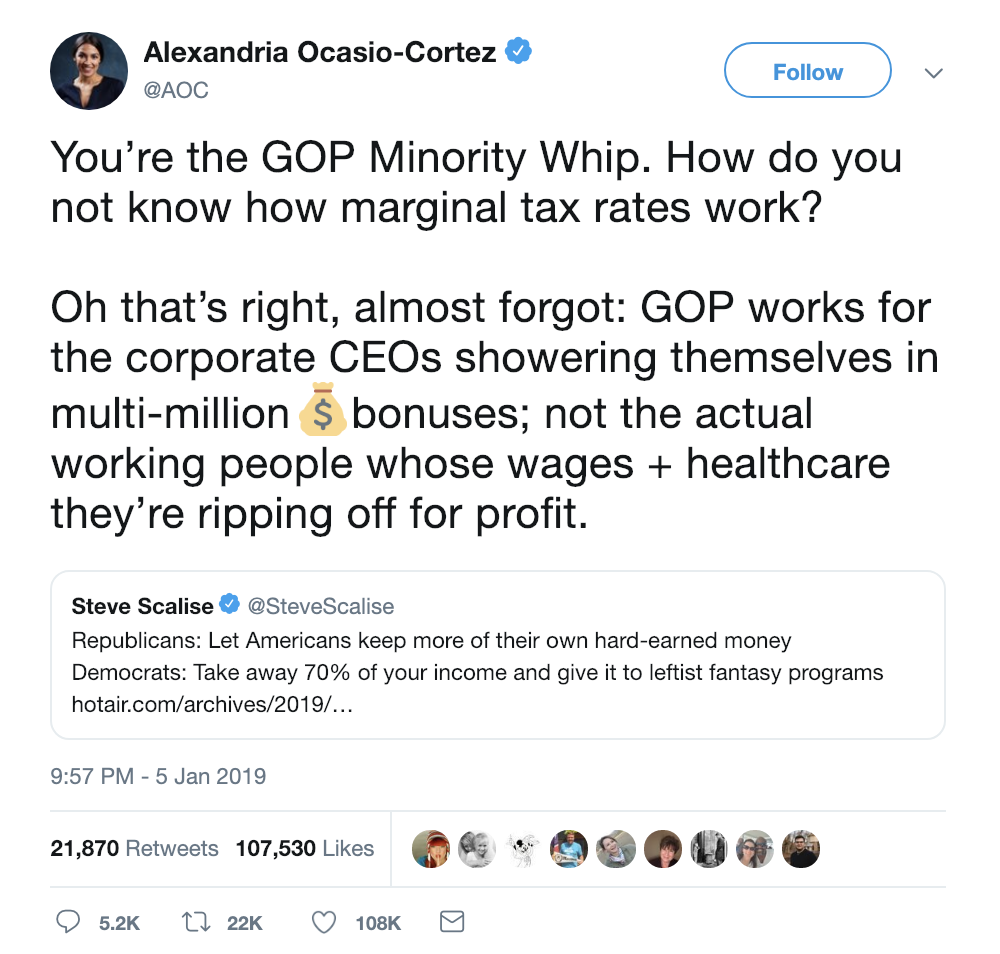

A person would have thought the new Representative had suggested using the guillotine on Donald Trump. Instead, she suggested raising the tax rate on the top tax bracket. House Minority Whip Steve Scalise (R-LA) was shocked, just shocked.

Scalise said the Democrats were suggesting “leftist fantasy programs:”

‘Republicans: Let Americans keep more of their own hard-earned money Democrats: Take away 70% of your income and give it to leftist fantasy programs.’

Then, Ocasio-Cortez shot back saying that the “GOP works for the corporate CEOs:”

‘You’re the GOP Minority Whip. How do you not know how marginal tax rates work? Oh that’s right, almost forgot: GOP works for the corporate CEOs showering themselves in multi-million

bonuses; not the actual working people whose wages + healthcare they’re ripping off for profit.’

Apparently, the minority whip does not know his history. The top tax rate was frequently 70 percent — and higher. According to The Bradford Tax Institute, this is how the upper income tax bracket ran from 1918 to now:

- 1918, 77 percent, World War I

- 1932, 63 percent, Depression

- 1944, 94 percent on taxable income over $200,000 ($2.5 million today)

- 1950’s-70’s, 70 percent, big important national programs

- 1982, 50 percent, The Economic Recovery Tax Act

- 1986, 28 percent, The Tax Reform Act of 1986

- 1990’s, 39.6 percent

- 2001, 35 percent, The Economic Growth and Tax Relief and Reconciliation Act of 2001

- 2012, 39.6 percent

- 2012, 43.4 percent, The Patient Protection and Affordable Care Act

- 2017, 39.6 percent, Trump’s presidency (Smart Asset)

- 2018, 37 percent.

The above taxes referred to taxable income for the highest bracket, and everyone was aware that the upper class could afford to pay for tax attorneys who can squeeze out every single dollar.

There has been the largest shift of money from the middle class to the upper class in recent history. They now own 30 percent of all the country’s wealth. The wealthy of the past were willing to pay their fair share for the good of the country, meaning a national interstate network and other infrastructure maintenance, Social Security, Medicare, and Medicaid.

Beginning in the 1980’s, the upper class was able to shift money from the middle class through tax changes, moving middle-class jobs out of the country, cheap imported products, dark money into political campaigns, and a number of other tricks.

Now, the Dems want their country back.

Featured image is a screenshot via YouTube.