The Trumps might not have the most acutely on-point financial know-how after all. On February 28, as the Coronavirus pandemic grew, Eric Trump took to Twitter to proclaim that he thought that the stock market was doing so great that observers should probably rush to invest. Within barely two weeks or so, the stock market had suffered a historic crash including an almost complete wipeout of all gains made during Donald Trump’s presidency and the largest single day fall since 1987. Great timing, Eric! He has since deleted that tweet in question.

.@EricTrump deleted his tweet advising people to buy stocks just ahead of a historical stock market crash pic.twitter.com/J2BScqETEY

— Aaron Rupar (@atrupar) March 13, 2020

Writer Dean Gloster pointed out that as of late Thursday, the overall stock market value had plummeted by about 16 percent since Eric’s self-confident Twitter proclamation otherwise. In about one month, since early February, the Dow Jones alone has plummeted by about 8,000 points in value; although this Friday, trading rallied ever so slightly — at least long enough to stop the free-fall — there’s still a long way to climb back up and no confirmation that further crashing isn’t on the way.

Today Eric Trump deleted this Feb 28 tweet that everyone should buy stocks. (The market has fallen about 16% since then.) It would be a shame if you retweeted this to remind him that he's not right. pic.twitter.com/gvqcA8YmnS

— Dean Gloster (@deangloster) March 13, 2020

As a quick perusal of Trump’s campaign trail commentary would reveal, he and his allies have banked a lot of their re-election arguments on the stock market successes. They’ve insisted upon the debunked myth that gains for those invested in the stock market would “trickle down” to everyone else. Without actual stock market gains to point to, the already struggling basis for that argument vaporizes.

thank you @EricTrump pic.twitter.com/iyynjG2NH1

— Rob (@robrousseau) March 13, 2020

The Trumps have been watching the situation closely. Over at the Federal Reserve, officials recently “announced trillions of dollars’ worth of new capital injections to calm Treasury-bill liquidity issues and boost economic activity amid coronavirus risks.”

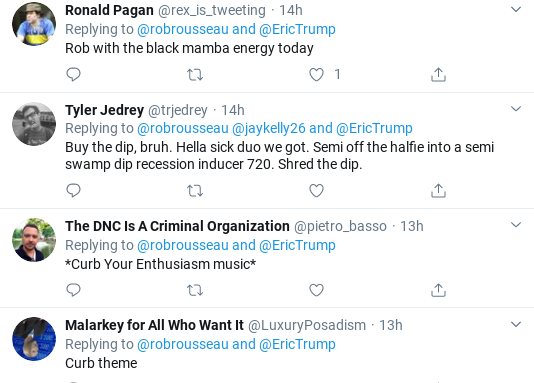

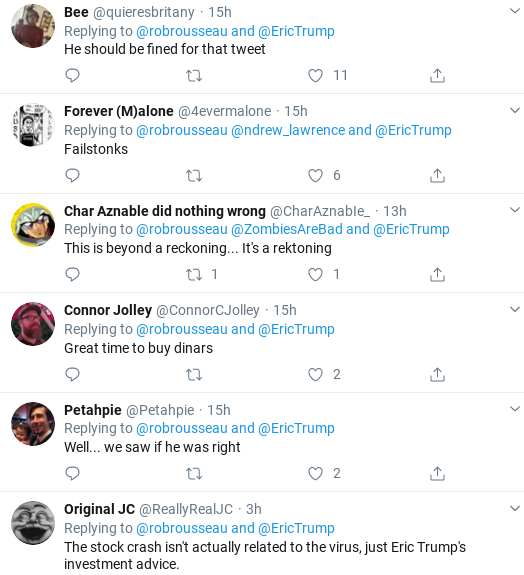

Check out Twitter’s response to Eric’s stumble: