During national crises like Hurricane Katrina and COVID-19, funds meant to help Americans recover are often misused by independent contractors and even government officials. In the Trump administration’s COVID-19 response, issues like those became irrelevant because our government was doing the grifting for them.

Pandemic Watchdog Is Probing Mnuchin, Cruz Roles in Fed Lending – Bloomberg https://t.co/Hm5rkuhAce

— Teresa C Carter (@TeresaCCarter2) February 1, 2021

On Tuesday, the Office of the Special Inspector General for Pandemic Recovery presented a report to Congress stating that both Steve Mnuchin, Trump’s former secretary of the treasury, as well as Sen. Ted Cruz (R-TX) are being investigated as a result of their actions during the administration of the vastly failed loan program implemented by congressional vote and meant to keep businesses suffering the effects of the pandemic open.

According to Bloomberg:

‘A federal watchdog is looking into former Treasury Secretary Steven Mnuchin’s decision to roll back the U.S. Federal Reserve’s emergency lending programs at the end of 2020, an issue that has become a point of partisan tension in Congress.

‘The Special Inspector General for Pandemic Recovery is also inquiring into Texas Republican Senator Ted Cruz’s role in persuading the central bank to expand the eligibility rules for the Main Street Lending Program to make it easier for oil and gas companies to apply for the low interest rate loans.’

PELOSI on @stevenmnuchin1 ending emergency fed lending … "Why would they do that?"

— Jake Sherman (@JakeSherman) November 20, 2020

When Mnuchin abruptly ended the distribution of allotted funds from the program to businesses, there appeared to be no rational explanation for his decision. Congressional leaders raised concerns, but the SIGPR is doing something about them. They are also probing Ted Cruz’s push to more quickly and easily extend those loan funds to oil companies, many of which are in his home state and donate handsomely to his campaigns.

According to the SIGPR report submitted to Congress:

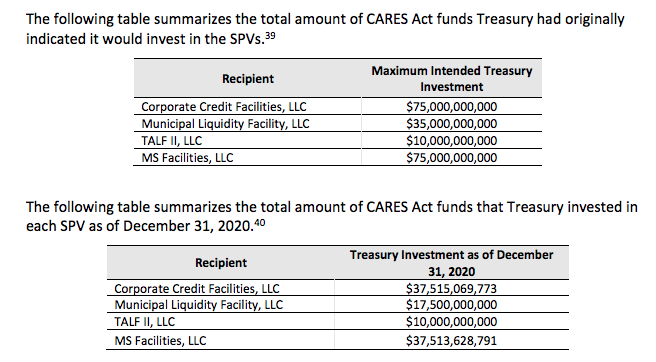

‘Before the Consolidated Appropriations Act, 2021, Treasury had invested $102.5 billion of CARES Act funds to support the Federal Reserve facilities. These included the Main Street Lending Program, the Primary and Secondary Corporate Credit Facilities, the Municipal Liquidity Facility, and the Term Asset-Backed Securities Loan Facility. For each program, Treasury invested in a limited liability company, known as a special purpose vehicle (SPV), which purchased specified assets or made loans to borrowers and is managed by one of the individual Federal Reserve Banks.’

Inside that December bill to provide a second round of COVID relief funds, language that allowed for the dismissal of concerns about the unused funds. No matter who decided to accept that language in order to get much-needed emergency relief to Americans, the SIGPR is skeptical and continues to investigate.

‘Any concerns abut the discontinuation of the Fed facilities was rendered moot because of the compromise lawmakers reached in the December stimulus legislation, though that position may not reflect the views of the current administration. Breen also said that they have not received a reply to the Jan. 6 letter about Cruz’s influence on the Main Street Lending Program.’

US Treasury Secretary Steven Mnuchin is pulling the plug on funding for emergency Federal Reserve programs intended to help businesses as the coronavirus pandemic continues to rage in the United States. https://t.co/I4mG2MGhQL

— CNN (@CNN) November 20, 2020