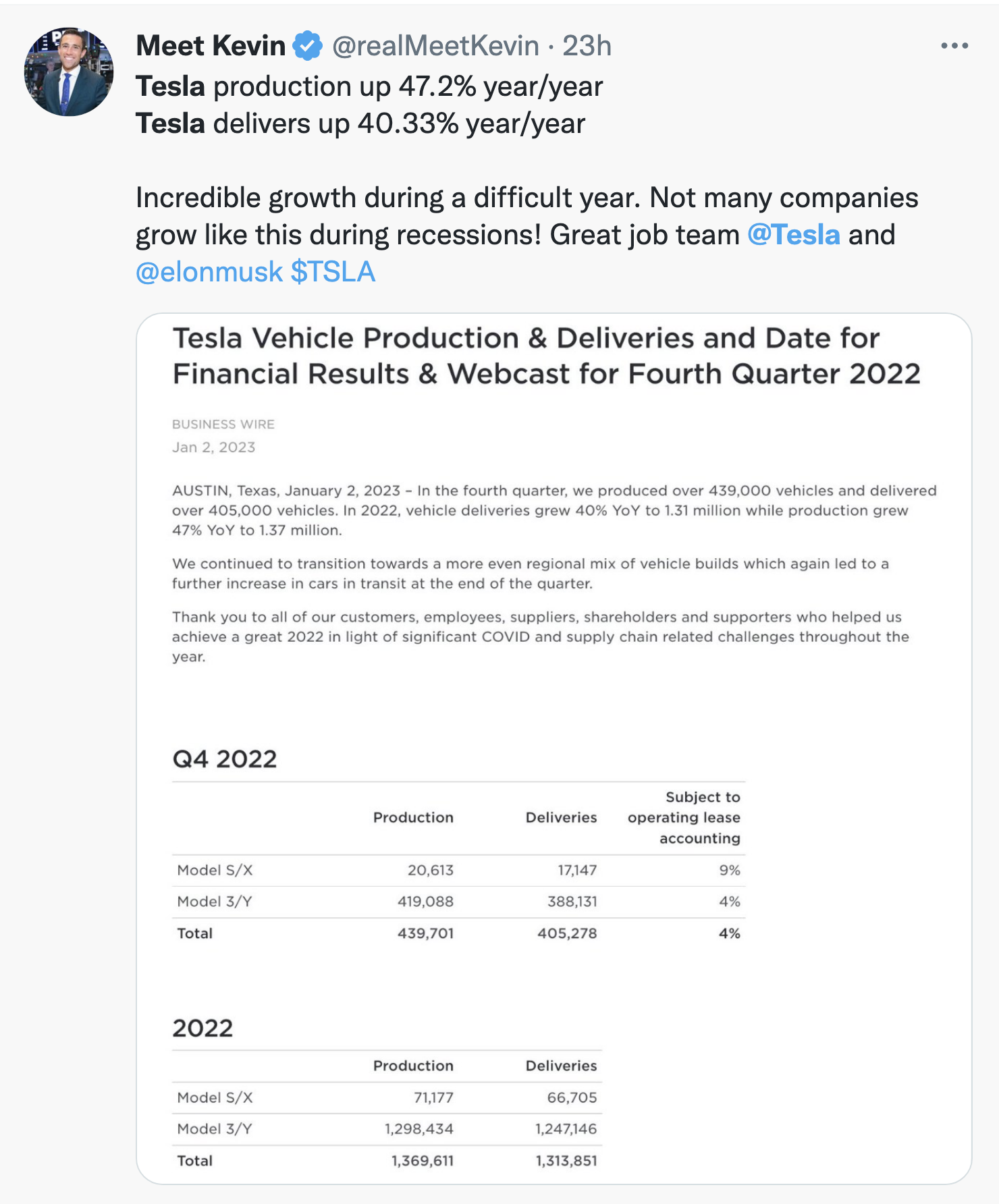

Tesla stock dropped 11 percent on Tuesday after the electric car owner reported his 2022 fourth-quarter production and delivery figures. But it is difficult to form any regrets for the formerly richest man in the world. Wall Street anticipated the company numbers would be 427,000 for the last quarter. Then in December, that number was adjusted to between 409,000 to 433,000, according to CNN. So what happened?

Tesla stock’s dive could be faulted with the:

- ‘Higher Interest Rates

- Increased EV Competition

- Backlash Against Tesla CEO Elon Musk’

- $44 Billion Twitter Buyout

‘The company’s shares ended 2022 down 65% for the year, greatly cutting into Musk’s net worth and knocking him out of his position as the world’s richest person. It was the worst year ever for Tesla shares, which gained 743% in 2020 and another 50% in 2021.’

Wedbush Securities Tech Analyst Dan Ives said:

‘Demand overall is starting to crack a bit for Tesla and the company will need to adjust and cut prices more especially in China, which remains the key to the growth story. ‘The Cinderella ride is over for Tesla.’

FactSet compiled a variety of analysts’ best estimates to come up with its numbers, according to CNBC. Even though Musk’s automobile company grew its deliveries 40%, that was still fewer deliveries than anticipated.

A number of Wall Street people believe this was the first sign of trouble for Musk’s primary business. Conversely, others see a “buying opportunity” in 2023.

Analyst for Baird, Ben Kallo, gave Tesla a top pick rating for the new year. The analyst indicated that he would continue to buy Tesla stock:

‘Q4 deliveries missed consensus but beat our estimates. Importantly, production increased ~20% q/q which we expect to continue into 2023 as gigafactories in Berlin and Austin continue to ramp.’

Morgan Stanley analysts said they think the company’s share price weakness is a “window of opportunity to buy:”

‘Between a worsening macro backdrop, record high unaffordability, and increasing competition, there are hurdles for all auto companies to overcome in the year ahead. However, within this backdrop we believe TSLA has the potential to widen its lead in the EV race, as it leverages its cost and scale advantages to further itself from the competition.’

Goldman Sachs analysts believe the Tesla autos provide a better buy “in a challenging macroeconomic environment:”

‘[The delivery report was an] incremental negative, [and Tesla is] well positioned for long-term growth, [And] a key driver of growth. We believe key debates from here will be on whether vehicle deliveries can reaccelerate, margins and Tesla’s brand.’

The auto magnet told his employees to not be “bothered by stock market craziness.” Musk faulted rising interest rates for the company’s stock price decline.

Shares of Tesla went into a year-long sell-off for the year 2022. Some analysts faulted Musk’s purchase of Twitter for a cool $44 billion right before Twitter’s stock took a nosedive. Many individuals left Musk’s enterprises when he opened up Twitter to extremist individuals and locked out anyone who criticized him.

Being the richest man in the world does not guarantee business savviness across all business sectors.

Gloria Christie is a political journalist for the liberal online newspaper The Bipartisan Report. Find her here on Facebook. Or at Three White Lions her book written in her own unique style with a twist of humor on Amazon Kindle Vella and the Gloria Christie Three White Lions podcast on Apple, Spotify, Amazon Music, etc. Christie’s Mueller Report Adventures In Bite-Sizes a real-life compelling spy mystery (in progress).